Have you set your 2020 resolution to cut down on unnecessary expenses? Well, it isn’t going to be easy, unless you have the right tools. There are thousands of budgeting Apps that help you manage your spending and income from one place. And you need the only one that best suits your requirements.

But why are Financial Goals necessary? You might want to build a good emergency fund for the coming year. Emergency Funds have long-term benefits. Or you might want to pull out of your debt obligations. Having no debt means you have full control over your income. Or maybe you are reaching your early 40’s and want to start planning for your retirement. Whatever the purpose of setting a Personal Financial goal might be, you need to remind yourself about your goals every day. Also, you need to make regular updates to your action plan and what better way to do that other than using a Budgeting App.

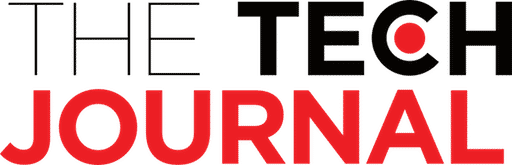

Spendee

Spendee is one of the best apps for managing personal finance and our team’s favorites in this genre. Spendee will help you track your money (both expenses and income) automatically through bank sync or manually so that you can analyze, organize and budget them for the future. You can invite others to manage your shared family or household budgets. With Spendee you can take control of your money in multiple currencies and across multiple bank accounts.

Find in iTunes | Find in PlayStore

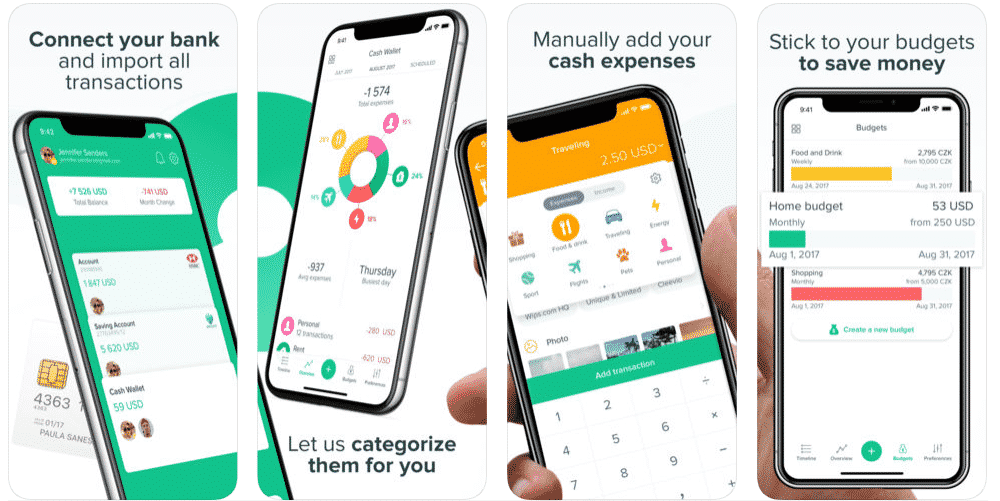

Mint

When you’re on top of your money, life is good. Mint helps you effortlessly manage your finances in one place. Record your expenses and select a category from the preset Expense Accounts. The same goes for the Revenue account. However, this App supports only five currencies.

Find in iTunes | Find in PlayStore

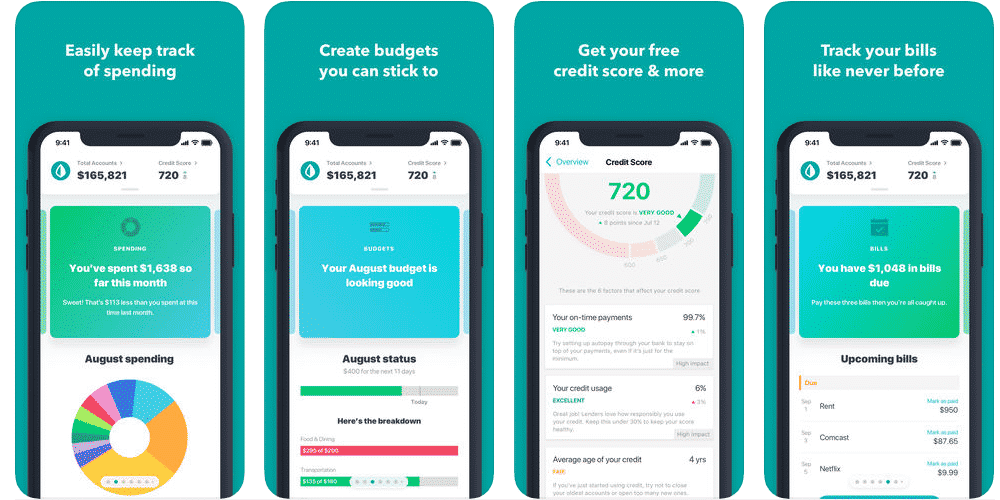

Wally

Wally Lite is the simplest and fastest way to track your expenses, income, set a savings target and scan receipts. Wally guarantees to get you started easily and keep you going all the way.

Find in iTunes | Find in PlayStore

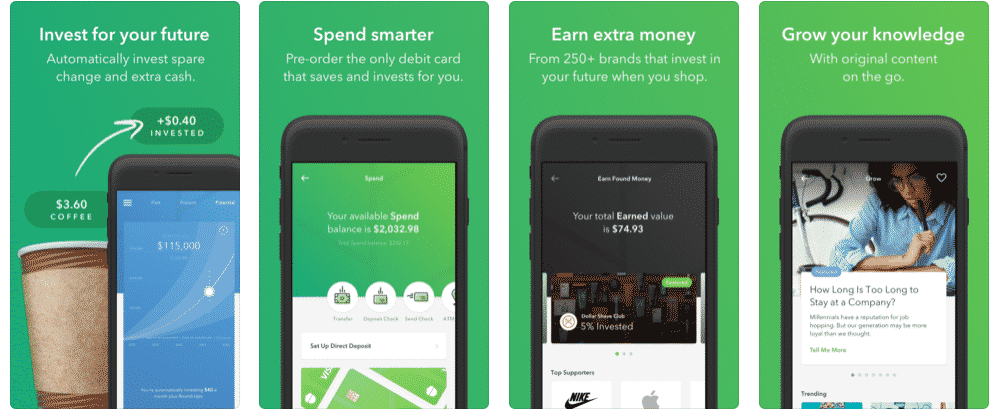

Acorns

Join over 4 million people who have started on the path to a brighter financial future with Acorns! From investing spare change every day to saving for later with tax advantages and spending smarter, get Acorns and grow your oak!

Find in iTunes

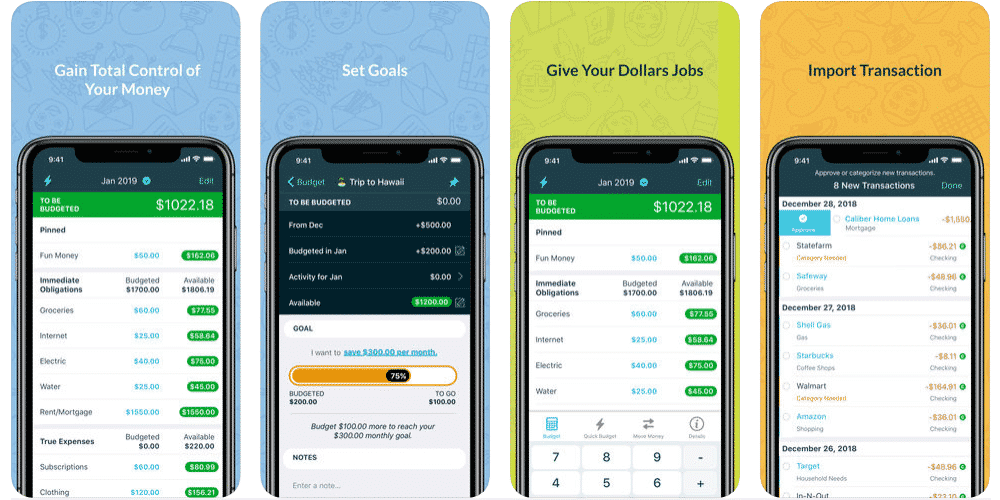

You Need a Budget

YNAB will help you break the paycheck to paycheck cycle, get out of debt, and save more money. On average, new users save $600 in the first two months and more than $6,000 in the first year. Try it free for 30 days.

Find in iTunes | Find in PlayStore

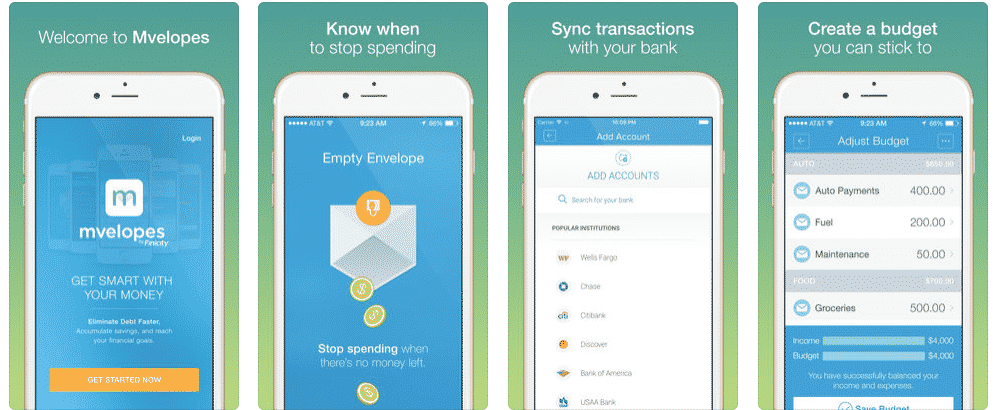

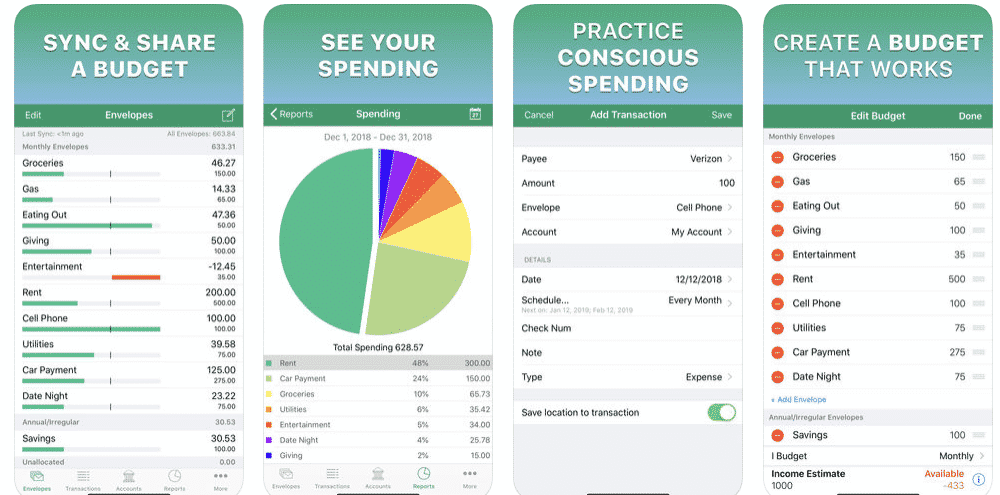

Mvelopes

Start today by downloading the Mvelopes budget app and use it for free for 1 month, add your financial institutions and come up with a budget that will keep you on the path to financial freedom. You will get all your transactions sent to your Mvelopes account and you will easily be able to track all your account balances in one easy to use the app.

Find in iTunes

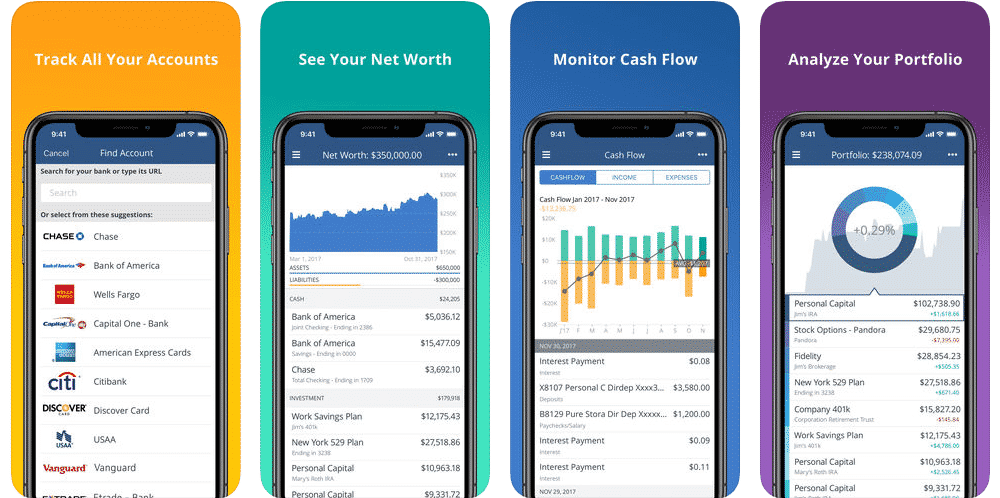

Personal Capital

Track and manage your financial life. Personal Capital combines award-winning financial tools with personal attention from registered financial advisors. Transform the way you understand, manage and grow your net worth.

Find in iTunes | Find in PlayStore

Goodbudget

Goodbudget is a personal finance app for budget planning and money management. Goodbudget is perfect for sharing a budget with a spouse, family member, or friend. Sync across multiple devices including iPhones, other smartphones, and the web.

Find in iTunes | Find in PlayStore

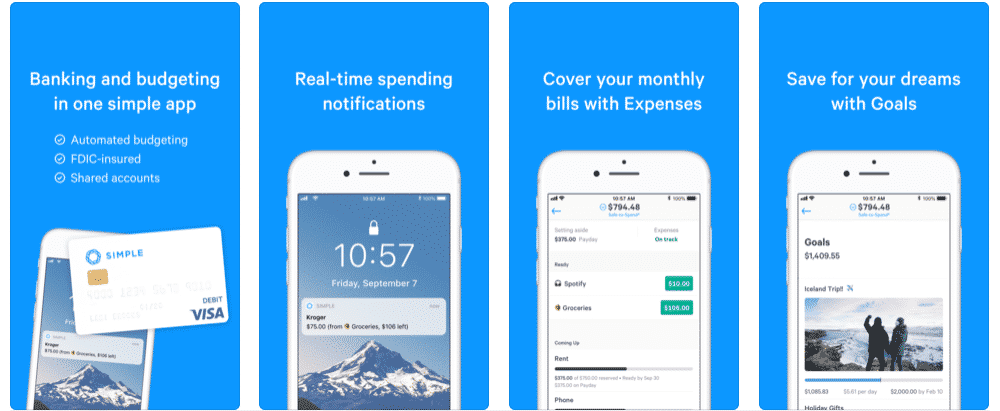

Simple

Simple gives you the banking tools you need to budget like a badass, save like a champ, and reach a newfound confidence with your money.

Find in iTunes

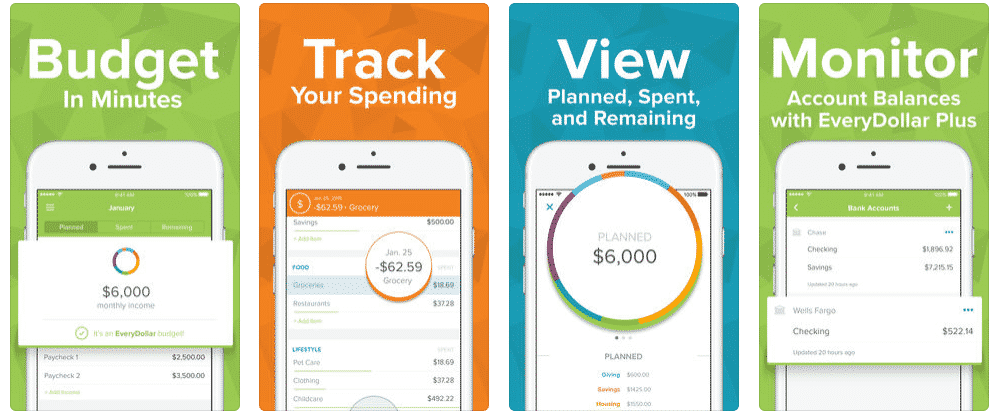

Every Dollar

EveryDollar follows the zero-based budget approach recommended by Dave Ramsey, a top personal money-management expert. Create daily and monthly budgets and track your expenses to manage and save money.

Millions are already using EveryDollar to budget and track their spending, beat debt and build their wealth. Start now and find the right way to budget your money!

Find in iTunes

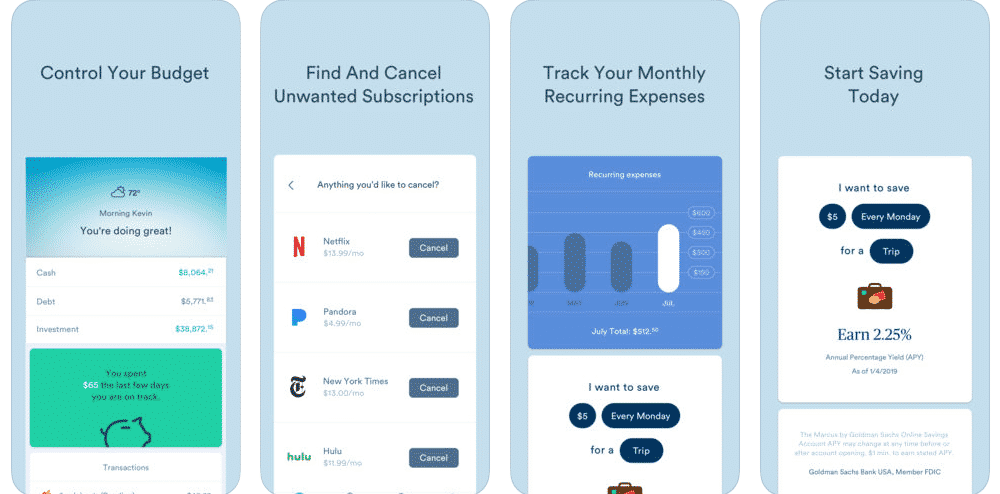

Clarity Money

Featured as Apple’s “App of the Day” on July 10, 2018, this app helps you take control of your budget and expenses. Clarity Money is here to partner with you along your financial journey. We use data science and machine learning to analyze your personal finances and help you make smarter decisions about your budget and spending.

Find in iTunes

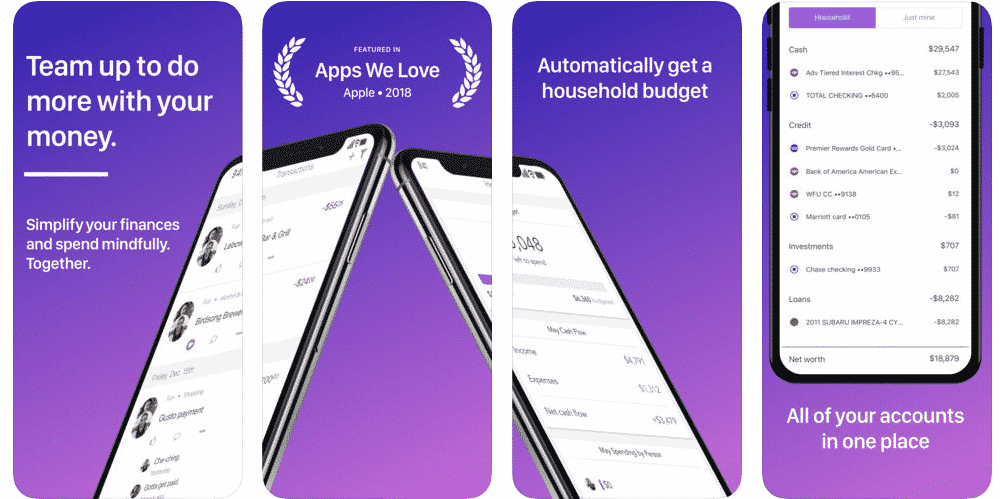

Honeyfi

With Honeyfi, it’s easy to collaborate with your partner about money. Just link your accounts to the app, choose what to share with your partner, and see your household finances – organized and categorized – in one place.

Find in iTunes

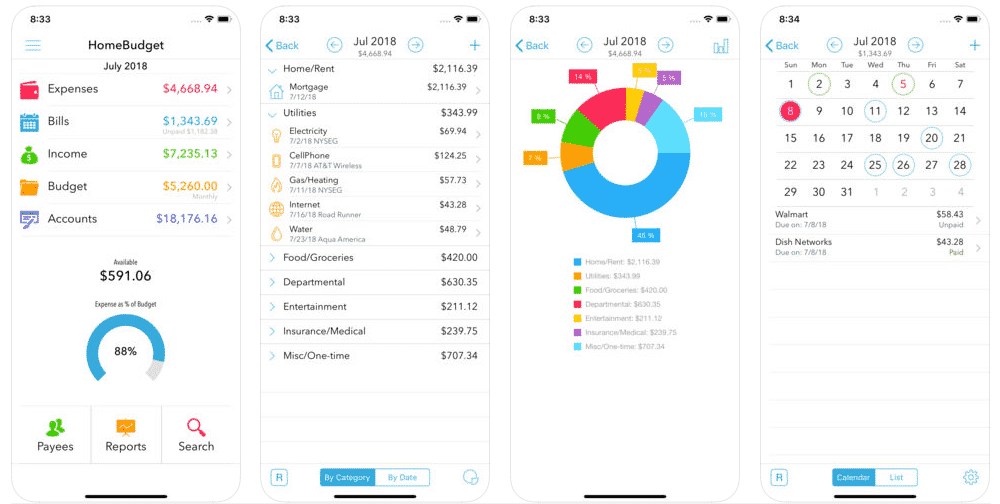

Home Budget

HomeBudget is an integrated expense tracker designed to help you track your expenses, income, bills-due and account balances. It offers support for budgeting and allows analysis of your expenses and income, including charts and graphs.

Find in iTunes | Find in PlayStore

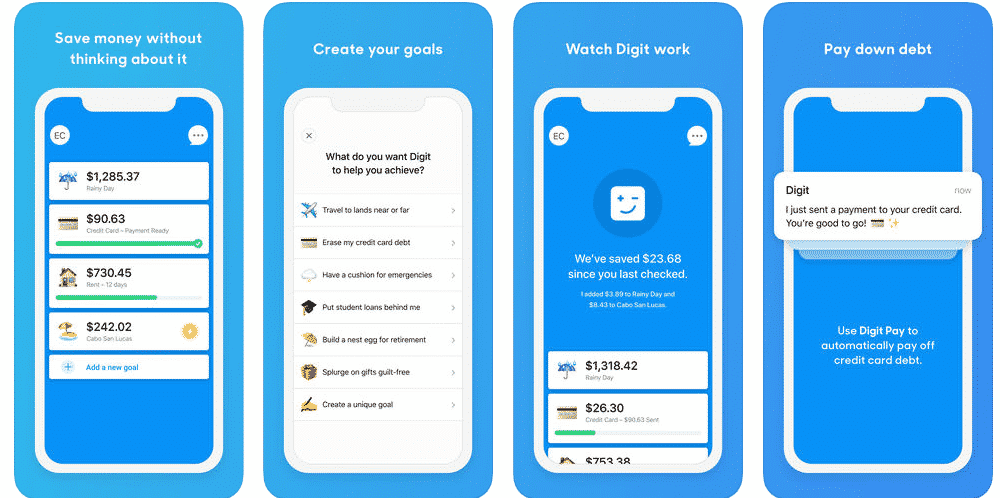

Digit Bot

Save money, pay off debt, and achieve your financial goals without thinking about it. Join the financial revolution that’s saved users $1 Billion. Digit is the smart money sidekick that keeps you financially healthy.

Find in iTunes

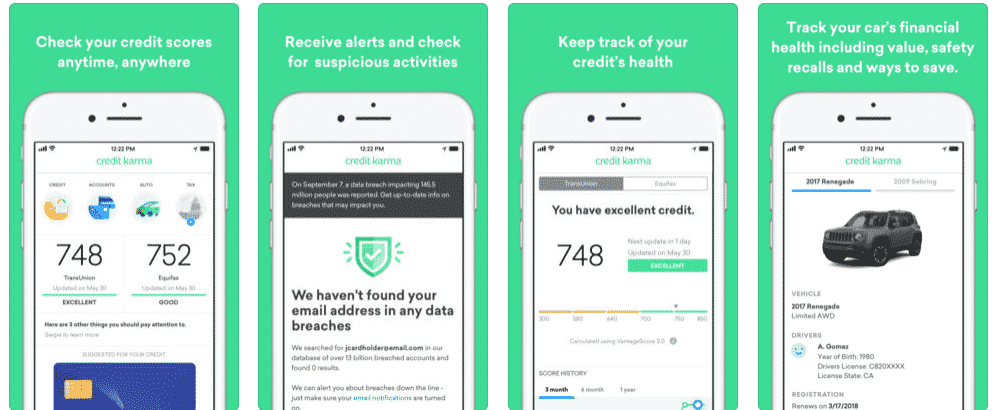

Credit Karma

Make the most of your credit, it’s totally free! Start by digging into your credit profile and finding out what goes into your credit scores. Then get important updates with credit monitoring, check out personalized recommendations, even file your taxes for free with Credit Karma Tax.

Find in iTunes

Wrapping Up!

Do let us know which App appears the most suited to you. Also, feel free to share your Personal Finance Goals with us.

![Read more about the article [Review] OnePlus 5: Wise And Powerful Phone Ever](https://thetechjournal.com/wp-content/uploads/2017/06/OnePlus-Reading-Mode-3-1-of-1-796x531-512x342.jpg)