Samsung Electronics announces third quarter 2011 results consolidated operating profit reaches 4.25 trillion won on revenues of 41.27 trillion won and this overall profit falls despite incredible phone sales. Samsung’s bread-and-butter chip business saw its profit more than halve to 1.59 trillion won from a year earlier, but it held up well as its relatively high exposure to lucrative mobile chips helped the firm offset a sharp plunge in prices of commodity computer memory chips and Samsung was the sole profitable firm among major global DRAM chip makers in the third quarter……………..

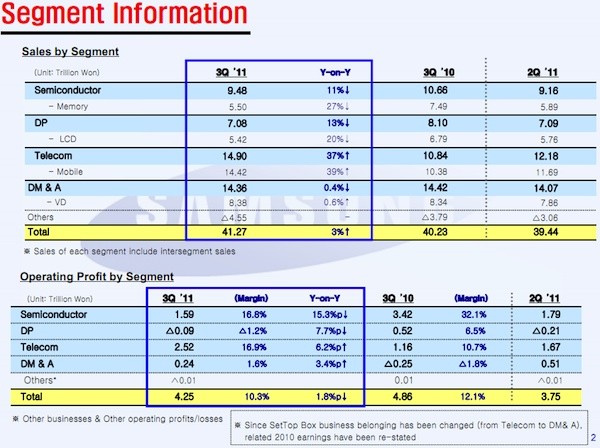

Samsung Electronics Co. Ltd. announced revenues of 41.27 trillion Korean won on a consolidated basis for the third quarter ended September 30, 2011, a three-percent increase year-on-year. For the quarter, the company posted consolidated net income of 3.44 trillion won, representing a 23-percent decrease year-on-year. Consolidated operating profit for the quarter was 4.25 trillion won. In its earnings guidance disclosed on October 7, Samsung estimated third-quarter consolidated revenues would reach approximately 41 trillion won with an operating profit of 4.2 trillion won. Highlighting the quarterly performance, the Telecommunications businesses recorded all-time high quarterly sales of 14.90 trillion won, up 37 percent from the previous year, with growth mainly driven by strong sales of Samsung‘s GALAXY smartphones. Operating profit for the businesses also hit a record 2.52 trillion won. The Semiconductor unit also saw sales hit 9.48 trillion won during the June-to-September period, after posting 9.16 trillion won in the second quarter. Increased demand for NAND flash chips used in mobile devices and enhanced revenue in the System LSI Business, which creates mobile application processors and CMOS Image Sensors, supported overall profitability. “Despite the difficult business environment due to the economic slowdown in developed markets, Samsung achieved a solid performance and recovered its double-digit operating profit margin in the quarter, driven by strong sales of our smartphones,” said Robert Yi, Vice President and Head of Investor Relations. “In anticipation of explosive growth in the mobile market, we have been focusing on fostering growth of certain component businesses, such as Mobile DRAM, application processors, NAND and OLED panels. These industry-leading technologies, combined with our design and software capabilities, have enhanced the competitiveness of our set products,” he said. Capital expenditure in the third quarter amounted to 4.9 trillion won, bringing year-to-date total investments to around 16 trillion won. Samsung will announce Capex plans for fiscal year 2012 in the fourth quarter earnings report. On the non-operating side, the rapid depreciation of the Korean won against the US dollar in September resulted in foreign exchange-related losses of around 420 billion won due to translation of foreign currency- denominated assets and liabilities. However, Samsung expects to recover the translation loss in the fourth quarter, considering the current strengthening of the won against the greenback.

Samsung‘s Semiconductor businesses – including Memory and System LSI – registered sales of 9.48 trillion won and a consolidated operating profit of 1.59 trillion won in the third quarter, declining both on-quarter and year-on-year. The Memory Business posted 5.50 trillion won in sales for the quarter, down from 7.49 trillion won posted the same period of 2010 and 5.89 trillion won in the second quarter of this year. Profitability in DRAM remained weak despite growth in global PC shipments in the high-single digit percentage quarter-on-quarter and a push in sales of mobile and server DRAM. Despite sluggish market conditions, Samsung maintained solid profitability through its differentiated memory solutions and cost leadership based on its migration to 30-nanometer-class DRAM production. The demand for NAND flash memory, which is a core component in mobile devices, remained strong as market growth in smartphones and tablet PCs continued to drive up orders. Spot prices for NAND flash memory rebounded in the third quarter due to decreased channel supply. In the fourth quarter, demand for PC memory will remain weak but DRAM for mobile devices and servers is projected to keep growing with the introduction of new products and a boom in the smartphone business. Samsung expects to keep its frontrunner status in the global memory semiconductor industry with competitive products and differentiated cost structure. The Display Panel Business recorded an operating loss of 90 billion won on revenue of 7.08 trillion won, representing a decline in sales of 13 percent compared with the same period last year. Global market demand for large size LCD panels was flat with shipments rising just 1 percent quarter-on-quarter to 179 million units, while average sales prices of panels fell across the notebook PC, monitor and TV panel segments. However, Samsung‘s overall on-quarter profitability improved on the back of demand for OLED panels from the growing tablet device market. Sales of light-emitting diode (LED) panels for TVs also showed continuous growth.Affected by the global economic slowdown, panel sales growth will continue to be limited in the fourth quarter although the year-end and Chinese New Year holidays are expected to lift demand. As demand for tablet devices increases, Samsung expects to maintain strong earnings momentum in the OLED business by broadening its customer base and offering a diverse product lineup.

The evolution of the industry will continue with LED TV panels sales expected to rise to account for more than 50 percent of the global market in the fourth quarter. The Telecommunications businesses – including mobile communications and telecommunication systems – posted a record operating profit of 2.52 trillion won on revenue of 14.90 trillion won. This represents an operating profit margin of 16.9 percent for the quarter. Samsung‘s Mobile Communications Business saw revenues rise 39 percent year-on-year to 14.42 trillion won. Handset shipments rose more than 20 percent quarter-on-quarter, driven by growth in the smartphone segment where sales were up more than 40 percent on-quarter and 300 percent year-on-year. Samsung continued the global rollout of its flagship GALAXY SII, which has now sold more than 10 million units in the five months since its introduction. Despite enhanced price competition, the average sales price of Samsung’s handsets increased on-quarter, while sales volume for the GALAXY Tab portfolio of tablets increased with the expansion of the 8.9- and 10.1-inch devices into the lineup. Samsung expects strong seasonal demand to drive sales of its diverse portfolio of smartphones in the fourth quarter assisted by the launch of new premium devices, including GALAXY Nexus which features the latest Android 4.0 operating system for the first time in a smartphone, and the 5.3-inch GALAXY Note which is opening a new mobile device category. Strong demand in developed countries will sustain tablet growth in the quarter. For the Telecommunications Systems Business, sales and profitability improved year-on-year due to the expansion of its 4G Long-term Evolution (LTE) business and 3G network upgrade business. Samsung expects strong network sales growth with expansion of LTE business in North America and Asia as well as 3G network upgrade business globally. Samsung‘s shipments of flat panel TVs outstripped market growth of more than 10 percent on-quarter, which was led by demand in emerging markets. Profitability also improved quarter-on-quarter as LED TV sales passed 50 percent of all Samsung LCD TVs sold for the quarter, reflecting the growing acceptance of the new technology. With peak season demand in the fourth quarter expected to increase 30 percent on-quarter, Samsung aims to outperform the market and enhance profitability through marketing and sales expansion of premium products such as LED TVs and Smart TVs supported by customized TV applications. For the Digital Appliances Business, the economic slowdown in developed markets resulted in weakening revenue and profitability, though sales grew in some emerging markets including the CIS and Africa. In the fourth quarter, the challenging global economy will continue to limit demand in developed markets although Samsung will look to target premium products for growth. Additionally, Samsung expects to capitalize on a slight increase in demand in emerging markets by expanding sales of its localized models.

[ttjad keyword=”samsung-galaxy-tab”]