Facebook puts the company’s value at $70 billion, but just last week Facebook was worth $84 billion and GSV Capital Corp. announced that it has bought 225,000 shares in Facebook at an average price of $29.28 per share. The price per shares is actually a bit lower than recent transactions for Facebook in private trades on markets and GSV becomes the latest plain big investment fund to try their hand at buying shares of hot, private companies such as Facebook, Zynga and Groupon……….

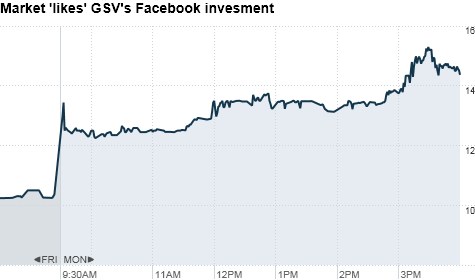

GSV Capital bought 225,000 shares of the social networking giant at an average price of $29.28 per share or a valuation of about $70 billion. The $6.59 million purchase in a private secondary transaction makes up about 15% of GSV’s portfolio, according to a spokeswoman. While retail investors wait for the eventual Facebook IPO, GSV could act as a very loose proxy for public valuation of Facebook shares–at least for now, since GSV only has Facebook and start-up Kno in its portfolio. So far investors like the deal, with GSV’s stock shooting up 28.82% or $2.96 to $13.23 Monday morning. Facebook has traded above $80 billion recently in secondary markets. An auction for Facebook stock last week on Sharespost closed at $35 per share, or $84 billion, assuming there are 2.4 billion shares outstanding. GSV is headed by Chief Executive Michael Moe, who was co-founder and former chairman of tech investment bank ThinkEquity Partners. GSV will invest in about 15 to 30 start-ups in secondary deals as well as primary direct investments. It will target companies between $100 million and $1 billion in valuation, with revenue growing at more than 40% annually. Facebook clearly falls out of that valuation range, but adding Facebook to GSV’s roster will certainly bring the firm some attention. GSV received very little media coverage when it first launched, but has garnered much coverage this morning. Will Facebook provide a halo effect for the rest of GSV’s portfolio? That will become clear when company announces more investments, which it plans do to in the next 30 days.

[ttjad keyword=”general”]