Technology has both advantages and disadvantages. While many technologies are there to prevent hack, at the same time there are some technologies as well as devices that are used directly or indirectly for hacking. Do you know that there are some tiny devices that can steal credit card data? And the very scary thing about these devices is they are very to detect.

Like most electronic gadgets these days, ATM skimmers are getting smaller and thinner, with extended battery life. Skimmers have always been designed to blend in with any ATM they’re attached to, but for years a discerning eye or tug of the card reader were often enough to uncover them. These miniature devices are very much hard to detect. Skimmers stealthily help fraudsters capture your credit and debit card data.

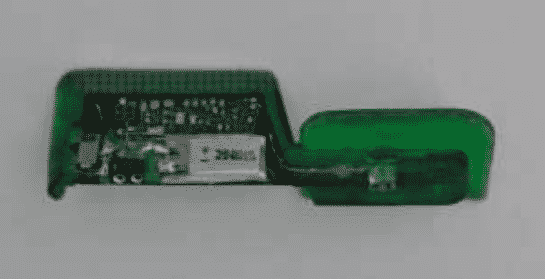

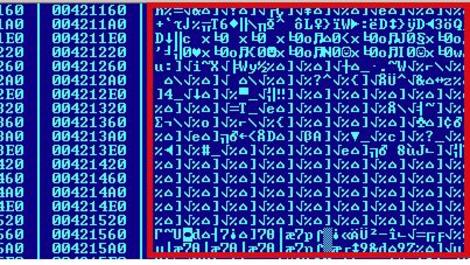

According to a new report from the European ATM Security Team (EAST), a novel form of mini-skimmer was reported by one country. Pictured below is a device designed to capture the data stored on an ATM card’s magnetic stripe as the card is inserted into the machine.

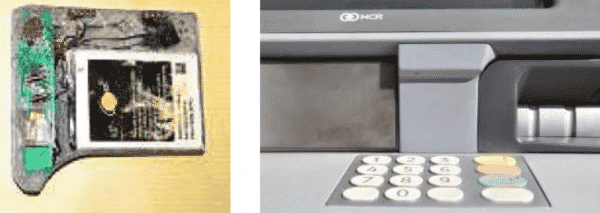

While most card skimmers are made to sit directly on top of the existing card slot, newer mini-skimmers fit snugly inside the card reader throat, obscuring most of the device. The above card skimmer was made to fit inside certain kinds of cash machines made by NCR.

The image on the left shows the hidden camera situated just to the left of the large square battery; the photo on the right shows the false ATM fascia that obscures the hidden camera as it was found attached to the compromised ATM (notice the tiny pinhole at the top left edge of the device).

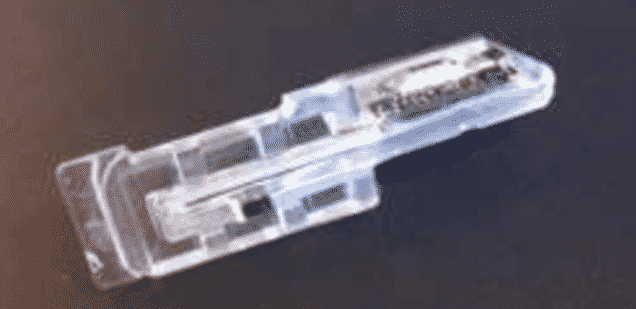

EAST has said that the same country which reported discovering the skimmer devices above also found an ATM that was compromised by a new type of translucent insert skimmer, pictured below.

EAST report concludes, “New versions of insert skimmers (skimmers placed inside the card reader throat) are getting harder to detect.”

So far it’s been reported that the ATM hackers in Europe will ship the stolen card data over to thieves in the U.S., who then can encode the stolen card data onto fresh (chipless) cards and pull cash out of the machines there and in Latin America.

Although the tech analysts are well aware of the matter, so they are working on further prevention from hacking via ATM machines. For now, the best protection is covering an ATM’s keypad when entering your PIN — and keeping your eyes open for card slots that show signs of tampering.

Source: Kerbs Of Security

Thanks To: Gizmodo

[ttjad keyword=”security”]

boston data recovery [url=https://otvetnow.ru]https://otvetnow.ru[/url] www yahoofinance

how do i apply for a mortgage [url=https://otvetnow.ru]https://otvetnow.ru[/url] houston house insurance

training in health care [url=https://otvetnow.ru]https://otvetnow.ru[/url] 75 ohm bnc connector

best arts colleges in the world [url=https://otvetnow.ru]https://otvetnow.ru[/url] atlanta botanical gardens concerts

suny electrical engineering [url=https://otvetnow.ru]https://otvetnow.ru[/url] top fleet management companies

nclex lvn [url=https://otvetnow.ru]https://otvetnow.ru[/url] celebrity prenups

montana wildlife [url=https://otvetnow.ru]https://otvetnow.ru[/url] degree in paranormal studies

one more day les mis [url=https://otvetnow.ru]https://otvetnow.ru[/url] car insurance list