Apple could buy out every major phone vendor except Samsung in cash and the analyst expects Apple to have about $70 billion in Cash, Cash Equivalents, Short-term marketable securities and long-term Marketable Securities. Apple will have amassed more than $70 billion in cash, cash equivalents, short-term marketable securities and long-term marketable securities, the enterprise value of Apple’s competitors has been shrinking. Apple will have a cash pile of $70 billion and could swallow every mobile company out there whole if it wanted to…………

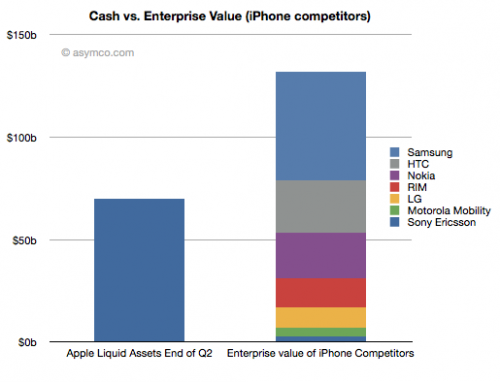

Apple has enough cash in the bank to buy virtually all it’s competition if it wanted to and with an estimated $70billion of cash sitting there waiting for the right moment, it means that it could buy Nokia, RIM, HTC, Motorola and Sony Ericsson and have change to spare. Asymco’s Horace Dediu has done some number crunching, comparing the current enterprise value of Apple’s major mobile competitors against the liquid assets that it has on hand and the results illustrate how dominant of a profit force that Apple’s mobile business has become in just 4 years. Dediu has compared the four main standalone competitors to Apple but has also made some educated estimations of the mobile divisions of larger companies like Samsung and Sony. At the moment only the inclusion of Samsung prevents Apple from having enough cash to cover a purchase of the whole mobile industry. Dediu explains that he chose the four major manufacturers that sell 75% of all phones sold worldwide for this comparison. The enterprise values of those companies are as follows:

- Nokia $22.6b

- RIM $13.8b

- HTC $25.4b

- Motorola Mobility $4.2b

He says that it was more difficult to calculate the value of mobile subsidiaries like Sony Ericsson, Samsung and LG but was able to generate an estimate using multiples of trailing operating profits. Given the troubles that RIM is in right now, its inclusion in this list isn’t too surprising. Apple currently has estimated liquid assets of $70B, greatly outstripping the enterprise value of all of its competitors combined, excepting Samsung. If Apple’s growth several continues as it has for the past several quarters in a row, even Samsung won’t be a barrier. Apple could soon have enough cash on hand to purchase all of its major competitors without breaking a sweat. Apple‘s growing war chest stems from the fact that the company is by far the most profitable in both the PC and phone hardware markets and Apple overtook the market leader Nokia in terms of profit in the smartphone business in late 2009, just over two years after the company entered the market with the iPhone. Apple sold 18.65 million iPhones, a record for the company, with sales growing 113 percent year over year and even with what was said this January to be a 4 percent share of total mobile phone units sold, Apple takes in more than half of the mobile industry’s profits.

[ttjad keyword=”general”]