After all LinkedIn filed paperworks for its IPO(Initial Public Offering) to SEC. Though this document does not tell us few important information, but it states information like LinkedIn has more than 90 million total members and previously they reported 55.1 million members in 2009. The company was able to double its 2009 revenues to $161.4 million in the first nine months of 2010, followed by increased revenue from advertising and job listings. Read details for more information.

Mashable‘s writer Ben Parr dugg through LinkedIn’s S1 paperworks and reported facts and figure. Here we will highlight details:

Morgan Stanley & Co. will be the lead underwriter for the IPO. It will be joined by Merrill Lynch, Allen & Company and UBS Securities.

LinkedIn decided not to disclose the target price for its IPO or the date, though it will almost certainly occur before the end of 2011. According to SharesPost, a secondary market for trading shares in private companies, LinkedIn is worth $2.51 billion. That number will likely rise as the IPO approaches.

Finance:

We also learned that 2010 is the first year LinkedIn was profitable. Although an income of $10.1 million isn’t that strong for a multi-billion dollar company, LinkedIn is definitely going in the right direction:

- Net revenue, Jan-Sept 2010: $161.4 million

- Net revenue, 2009: $80.8 million

- Total expenses, Jan-Sept 2010: $148.9 million

- Total expenses, 2009: $84.1 million

- Net income (after tax), Jan-Sept 2010: $10.1 million

- Net income (after tax), 2009: -$3.4 million

- Cash on hand (as of Sept 30, 2010): $89.6 million

- Total assets (as of Sept 30, 2010): $197 million

In addition, LinkedIn revealed its revenue breakdown. From January 2010 to September 2010, LinkedIn earned $161.4 million in revenue from three products: hiring solutions (job listings), marketing solutions (advertising) and premium subscriptions.

Here’s the breakdown:

- Job listings, Jan-Sept 2010: $65.9 million (41% of revenue)

- Job listings, 2009: $23.75 million (29% of revenue)

- Advertising, Jan-Sept 2010:$51.37 million (32% of revenue)

- Advertising, 2009: $23.8 million (30% of revenue)

- Premium subscriptions, Jan-Sept 2010: $44.1 million (27% of revenue)

- Premium subscriptions, 2009: $33.2 million (41% of revenue)

Matrix:

LinkedIn is gaining very fast now. Check details

- Registered users: 90 million (as of December 31, 2010)

- Unique visitors: 65 million (average of Oct, Nov and Dec)

- Pageviews: 5.5 billion (average of Oct, Nov and Dec)

- Employees: 990 (as of December 31, 2010)

Shareholders & Stake Details:

The following is a list of LinkedIn shareholders with more than a 1% stake in the company:

- Reid Hoffman and Michelle Yee: 19,066,032 shares, 21.4% ownership.

- Sequoia Capital: 16,840,309 shares, 18.9% ownership.

- Greylock Partners: 14,047,978 shares, 15.8% ownership.

- Bessemer Venture Partners: 4,578,253 shares, 5.1% ownership.

- Jeffrey Winer, CEO: 3,844,512 shares, 4.1% ownership.

- Steven Sordello, CFO: 1,007,327 shares, 1.1% ownership.

- Dipchand “Deep” Nishar, VP Product & User Experience 970,000 shares, 1.1% ownership.

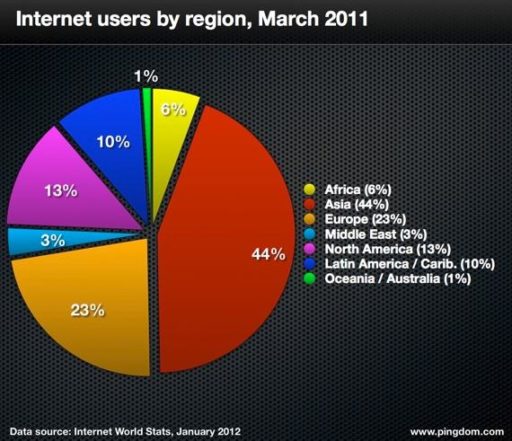

Social Media is powerful now. LinkedIn truly shown how social media could affect executive and job field. Its clear most US people who works in any company already have LinkedIn profile and its gaining and has more scope to grow worldwide. Do you have LinkedIn profile? Why not share your story with us if your LinkedIn profile helped you in getting job or doing more business.

Resource: Mashable, LinkedIn’s length S-1 registration statement

Great, now that Linkedin has gone public, how about hiring someone to respond to the numerous inquiries I have sent. You cannot get any response from this organization and it’s clear that there are some serious technical issues which can lock someone out of their account (that’s the majority of people’s frustrations), or worse yet, people stealing someone’s identity and creating fictitious profiles.