Microsoft announces record Q3 earnings , sng enterprise and Xbox momentum drive revenue growth of 13% and earnings per share of $0.61 and also $16.43 billion revenue, $5.23 billion net income.The main reason for the anxiety: Revenue in the division that includes Microsoft’s foundation, the Windows operating system, declined from the same time last year for the second-straight quarter and the slide stems from consumers buying fewer personal computers that run the company’s software………..

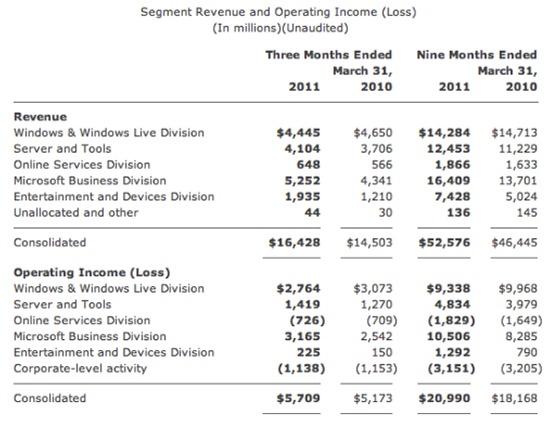

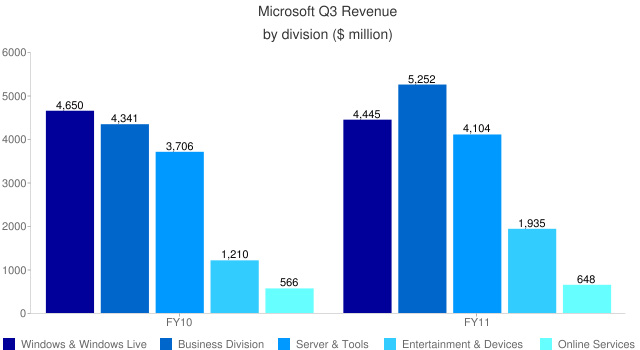

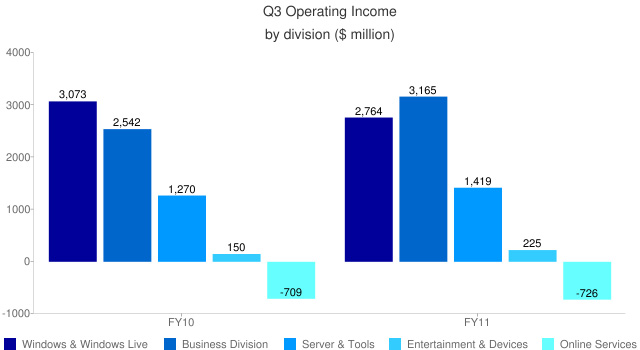

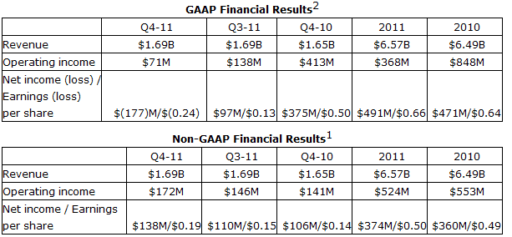

Microsoft Corp. announced third-quarter revenue of $16.43 billion for the quarter ended Mar. 31, 2011, a 13% increase from the same period of the prior year. Operating income, net income and diluted earnings per share for the quarter were $5.71 billion, $5.23 billion and $0.61 per share, which represented increases of 10%, 31%, and 36%, respectively, when compared with the prior year period. Diluted earnings per share included a $0.05 tax benefit primarily related to an agreement with the U.S. Internal Revenue Service to settle a portion of their audit of tax years 2004 to 2006.“We delivered strong financial results despite a mixed PC environment, which demonstrates the strength and breadth of our businesses,” said Peter Klein, chief financial officer at Microsoft. “Consumers are purchasing Office 2010, Xbox and Kinect at tremendous rates, and businesses of all sizes are purchasing Microsoft platforms and applications.”Microsoft Business Division revenue grew 21% year-over-year. Since its release last spring, Office 2010 has become the fastest-selling version of Office in history and the integrated innovation with SharePoint, Exchange, Lync and Dynamics CRM is driving significant growth for the division.

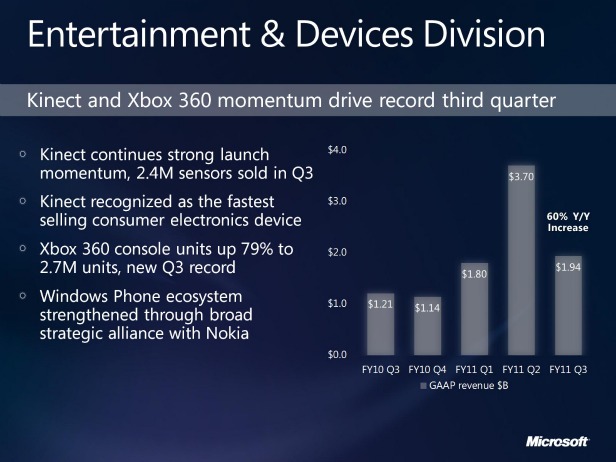

Server & Tools revenue grew 11% year-over-year, the fourth consecutive quarter of double-digit growth. Strong business adoption of Windows Server 2008 R2, SQL Server 2008 R2 and System Center are driving record revenue and margin expansion.Windows 7 remains the fastest selling operating system in history with 350 million licenses sold. Revenue for the segment was down 4% in the third quarter in line with the PC trends, excluding prior year launch impact.Online Services Division revenue grew 14% year-over-year primarily driven by increases in search revenue. Bing’s US search share increased to 13.9% this quarter.Entertainment & Devices Division grew 60% year-over-year, fueled by Kinect for Xbox 360, the fastest-selling consumer electronics device in history, continued strong Xbox 360 console sales and growth of Xbox Live.“We delivered strong third quarter revenue from our business customers, driven by outstanding performance from Windows Server, SQL database, SharePoint, Exchange, Lync and increasingly our cloud services,” said Kevin Turner, chief operating officer at Microsoft. “Office had another huge quarter, again exceeding everyone’s expectations, and the addition of Office 365 will make our cloud productivity solutions even more compelling. We continue to see strong adoption of our cloud-based services among the Fortune 500.”

Microsoft reaffirms operating expense guidance of $26.9 billion to $27.3 billion for the full year ending June 30, 2011. Microsoft also offers preliminary fiscal year 2012 operating expense guidance of 3% to 5% growth from the mid-point of fiscal year 2011 guidance, or $28.0 billion to $28.6 billion.Microsoft reaffirms operating expense guidance of $26.9 billion to $27.3 billion for the full year ending June 30, 2011. Microsoft also offers preliminary fiscal year 2012 operating expense guidance of 3% to 5% growth from the mid-point of fiscal year 2011 guidance, or $28.0 billion to $28.6 billion.

[ttjad keyword=”general”]